Top 10 Crypto Countries to Watch in 2025: Global Leaders in Digital Finance

Top 10 Crypto Countries : As cryptocurrencies mature into a serious asset class, nations across the globe are competing to attract talent, investment, and innovation. The top 10 crypto countries in 2025 aren’t just embracing Bitcoin — they’re shaping the entire digital finance ecosystem.

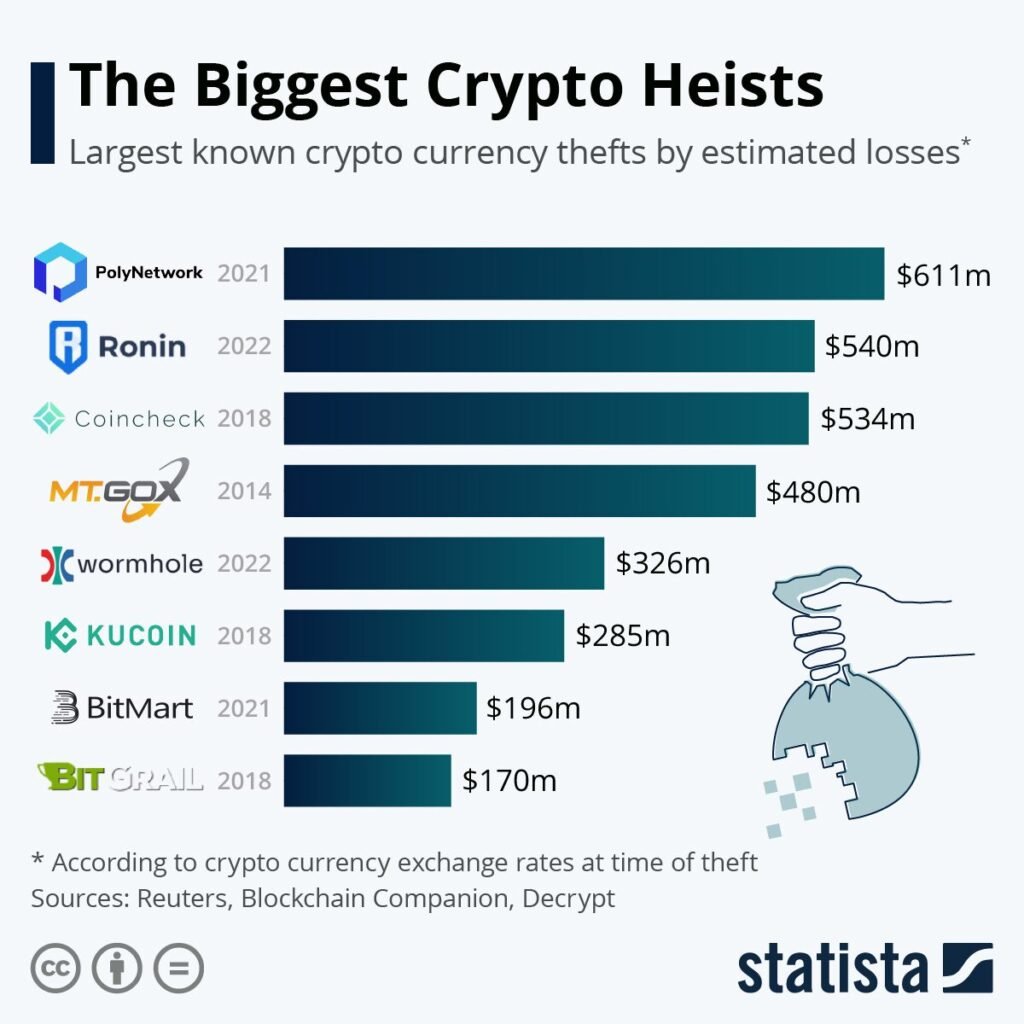

The road here wasn’t smooth. The industry endured the 2021–2022 crash, high-profile failures like Terra-Luna and FTX, and regulatory battles. But recovery signs emerged in 2023, with Bitcoin rebounding and market capitalization climbing past $1.5 trillion. The momentum continued in 2024 after the SEC’s approval of Bitcoin ETFs, the Bitcoin halving, and renewed investor interest following U.S. political shifts.

Today’s leaders in crypto adoption have built environments where blockchain startups can grow, investors feel secure, and regulations encourage innovation. Let’s explore them.

Switzerland: Europe’s Blockchain Capital

Source: Token Information

Switzerland’s “Crypto Valley” in Zug remains a benchmark for blockchain-friendly jurisdictions. The Swiss Financial Market Supervisory Authority (FINMA) provides clear, predictable rules for token offerings and crypto services. Combined with investor-friendly taxes and a trusted banking system, Switzerland offers both security and opportunity for digital asset companies.

Singapore: Where Policy Meets Innovation

Singapore’s government has taken a structured, progressive approach to crypto. Under the Payment Services Act, companies benefit from regulatory clarity, while investors enjoy no capital gains tax. Universities and tech institutions feed talent into a vibrant blockchain sector, supported by major events like Singapore Blockchain Week.

United Arab Emirates: The Middle East’s Crypto Gateway

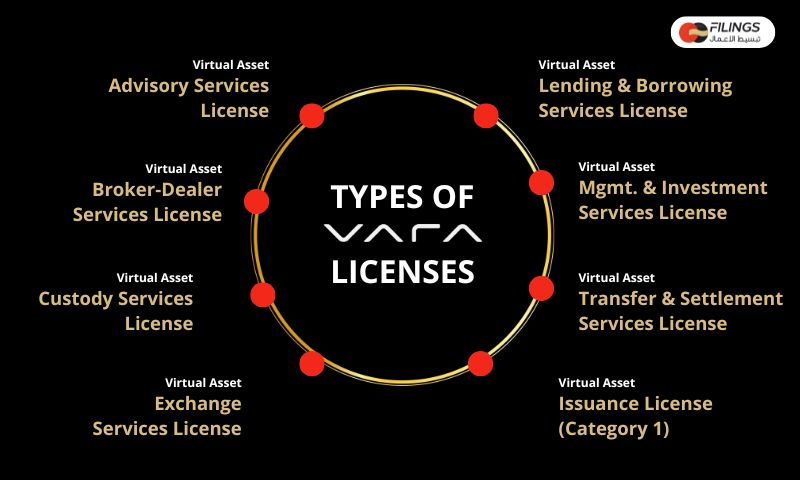

Source: Filings

The UAE, particularly Dubai and Abu Dhabi, has transformed into a regional crypto hub. Dubai’s VARA framework and Abu Dhabi Global Market’s regulated ecosystem attract both startups and established exchanges. Zero personal income tax, free trade zones, and blockchain-focused education programs keep the UAE ahead in the race for adoption.

Hong Kong: Reclaiming Its Crypto Hub Status

Source: Blockchain News

Once cautious, Hong Kong is now making strong moves to re-establish itself in the digital asset space. The Securities and Futures Commission (SFC) has issued clear guidelines for exchanges, while government-backed tokenization projects signal institutional support. Its location between mainland China and global markets makes it a strategic base for crypto finance.

Canada: First-Mover Advantage in Regulation

Canada led the world in approving Bitcoin ETFs and crafting early regulatory frameworks for crypto. The openness of its banking sector to digital asset businesses has been a significant driver of adoption. While taxation is more traditional, Canada’s legal clarity and innovation-friendly climate keep it among the top global players.

United States: Top 10 Crypto Countries – Powerhouse of Capital and Talent

Source: Statisca

The U.S. remains one of the largest players in crypto, with deep venture capital pools, institutional adoption, and a thriving startup scene. While federal regulation remains complex, state-level initiatives — from Wyoming’s pro-crypto banking laws to Texas’ mining incentives — create localized hubs of innovation.

Cayman Islands: Offshore Advantage for Digital Assets

Known for its role in global finance, the Cayman Islands has adapted smoothly to the crypto era. Its Virtual Asset Service Providers Act offers a regulatory structure without imposing direct taxes on transactions. This, paired with strong financial services infrastructure, makes it a favored jurisdiction for funds and exchanges.

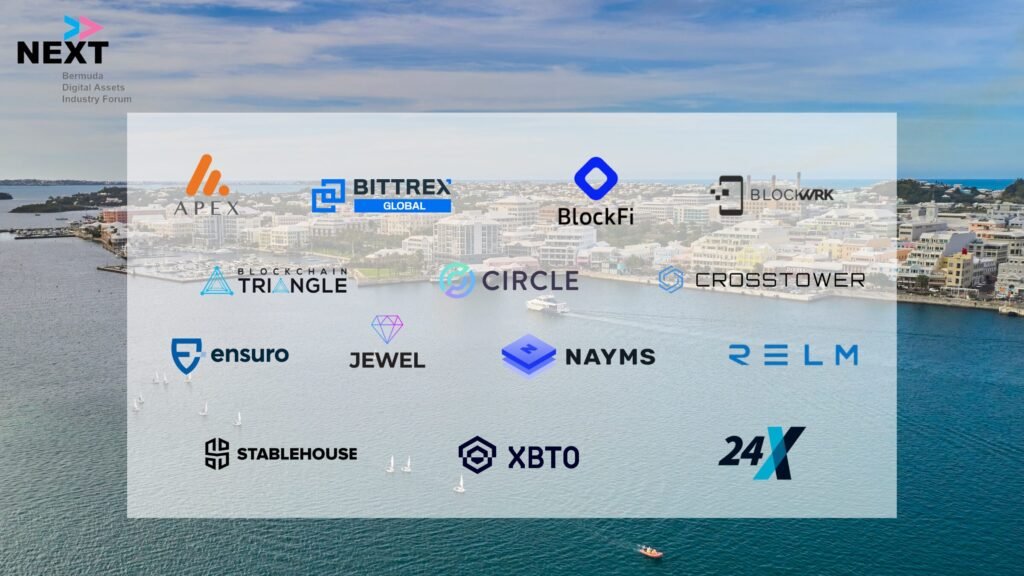

Bermuda: Top 10 Crypto Countries – Agile and Proactive in Digital Regulation

Source: Businesswire

Bermuda’s Digital Asset Business Act (DABA) provides a clear path for licensing and compliance, while the Bermuda Monetary Authority actively engages with the crypto sector. Tax benefits and dedicated blockchain education initiatives make the island a surprising but powerful player in global adoption.

Australia: Balancing Oversight with Opportunity

Australia’s regulators have created a transparent framework for digital asset businesses through ASIC, while allowing innovation through a regulatory sandbox. Government partnerships with blockchain projects and fair tax treatment for active traders position Australia as a leader in the Asia-Pacific region.

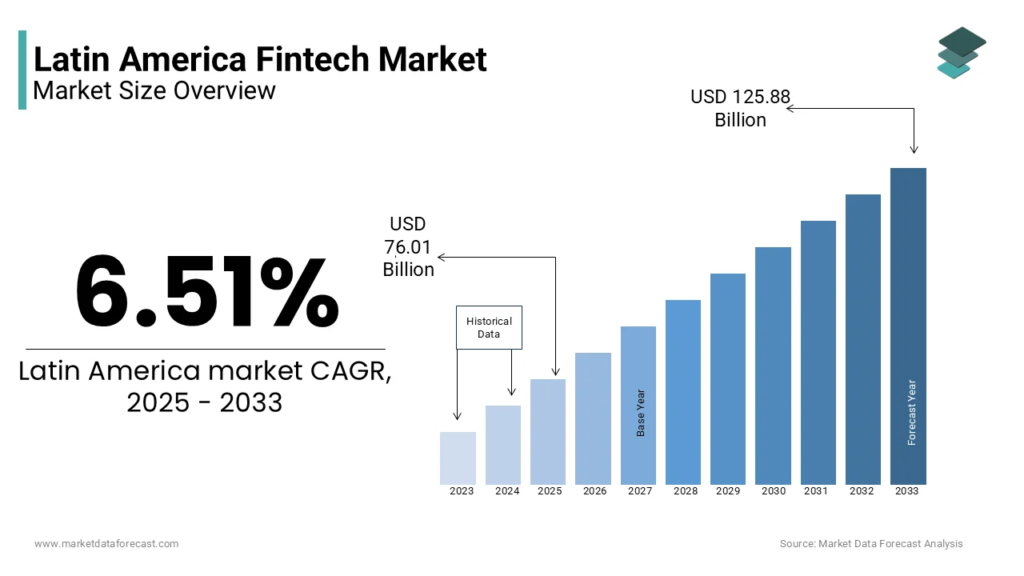

Panama: Top 10 Crypto Countries – Strategic and Tax-Friendly

Source: Market Data Forecast

Panama’s appeal lies in its zero capital gains tax on crypto and its growing fintech ecosystem. While its AML framework is still evolving, its location as a trade and finance bridge between North and South America gives it a unique edge in attracting global crypto businesses.

Conclusion: Top 10 Crypto Countries – A Shifting Global Crypto Map

The top 10 crypto countries of 2025 share a willingness to embrace innovation while providing regulatory certainty. Tax benefits, skilled talent pools, and robust financial systems have made them leaders in the global shift toward blockchain-based economies. In the years ahead, expect competition to intensify as more nations see crypto as not just a technology — but a strategic economic driver.